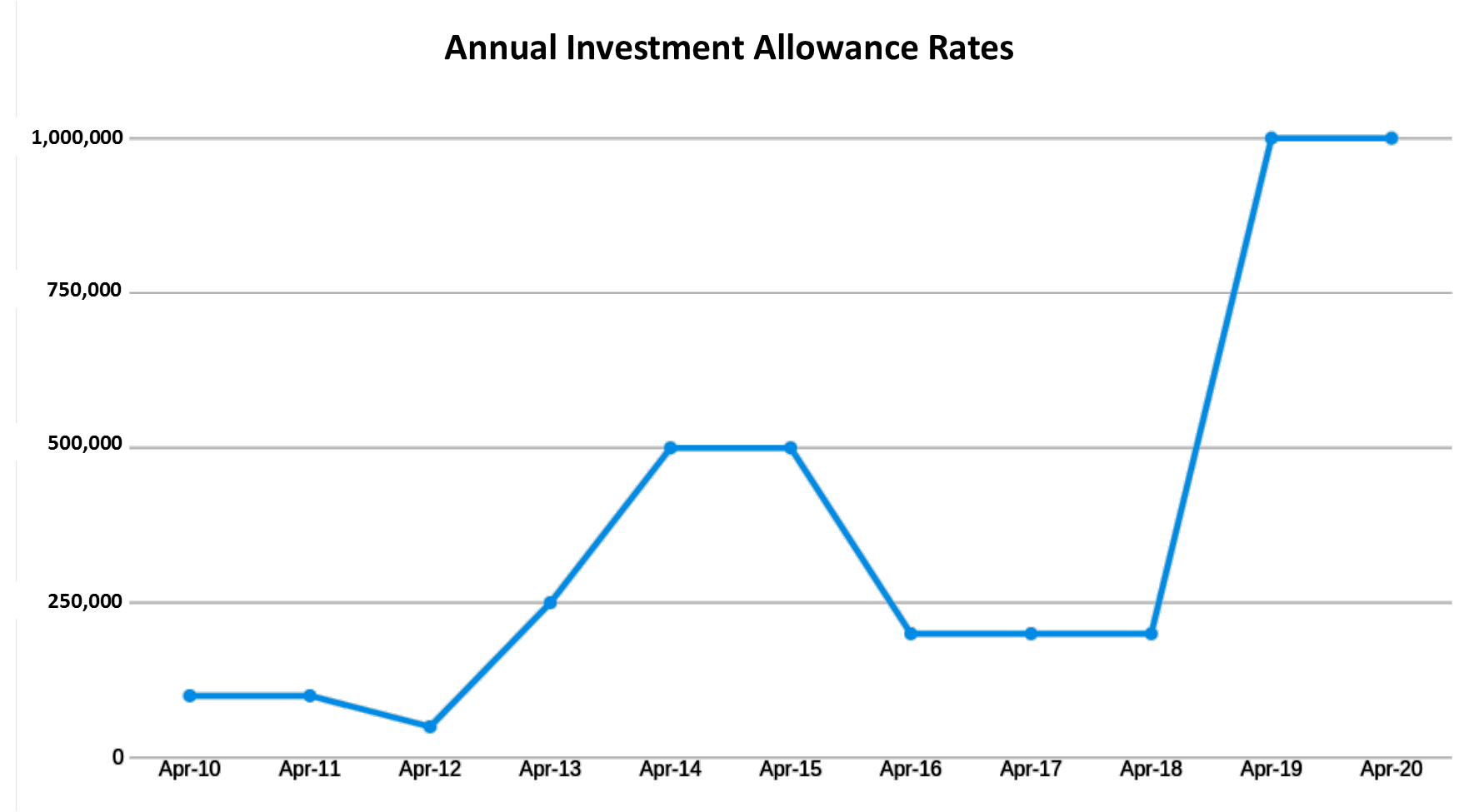

As announced in the Budget 2018, legislation has been introduced in the Finance Bill 2018/19 to temporarily increase the Annual Investment Allowance from £200,000 to £1million. The changes will be in effect from 1st January 2019, until 1st January 2021 when it will revert back to £200,000.

The AIA, in effect, enables businesses to be able to claim immediate relief for expenditures, as it enables the business to deduct 100% of qualifying capital expenditure up to the AIA limit for the chargeable period when calculating profits. There are some excluded expenditures such as expenditure on cars.

Although a claim is not compulsory (and sometimes not beneficial), the AIA has to be claimed. The expenditure will attract writing down allowances instead, where the AIA is not claimed or where it has been used up.

It is important to note that this would be impacted by the company’s year-end. For example, the maximum AIA available for expenditure on plant and machinery to the year ended 30 June 2019 would be £600,000 being 6/12x £200,000 plus 6/12x £1,000,000.

Why has it been changed?

The hope is that the increase in the allowance will help to stimulate business investment, particularly with the approach of Brexit which has seen many businesses delaying investment decisions and fewer Capital allowance claims over the past year. Some experts however are worried that it will create confusion for those businesses whose expenses are below the annual cap.

According to HMRC there are 30,000 businesses which have annual expenditure on qualifying assets which is greater than the £200,000 limit.

All smooth sailing?

Those businesses who will benefit from this increase have welcomed the change, however 97% of UK businesses who fall below the annual ceiling may find that the change brings many complications. Some businesses have found that that due to their annual expenditure in their accounting year falling below the annual limit, they have not been able to claim the full benefit.

Some experts are discussing whether businesses below the limit should be able to opt out of the allowance change and continue with the limit as it was, prior to 2019, so that all business will be able to fully benefit.

It is hoped that in the future there will be some assured stability of the AIA rate so that businesses can properly plan and prepare their expenditure

If you would like further details on what the rise in the Annual Investment Allowance means for your business, then please contact us for more information.