Due to the amount of criticism that the Gift Aid Scheme has received from the charities that use it on a regular basis, the government has made some changes. Some of the complaints included the length of the HMRC wording was putting donors off, the complexity of donor benefit rules and the administrative burden of storing and retrieving the declarations.

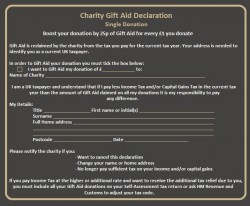

Looking at the HMRC’s new model gift aid declaration what has changed?

The first noticeable change is that the declaration is considerably shorter, as there is no longer and reference to VAT and council tax, making it much clearer to see the value of making a Gift Aid claim.

You may notice that the implications of gift aiding your donation without paying enough tax are much more apparent. There is a split view on this increased focus and the Charity Tax Group feel that it could have a chilling effect on donors, but this is for the benefit of the donor and should prevent them from receiving any unanticipated bills.

The new declaration will apply to all one-off donations, multiple donations and sponsored events. Charities must change all written and oral declarations that they use by 5th April 2016, although if you are using declarations that were printed before 21st October 2015 then this is said to be acceptable.

There are some further changes to be made to the way that gift aid is used, which includes changes to the donor benefits. HMRC are now allowing charities to provide donors with small benefits in return for a gift aid donation. The government reviewed a number of the donor benefit rules and suggested making more changes, but a consultation on any changes to be made should be held at some point this year.

Charity shops using the ‘Retail Gift Aid Scheme’ can claim gift aid on the money earned from the sale of goods if the donor has declared so. However, HMRC is concerned that some charities may not be using the process correctly and have made substantial changes to their guidance on the website. So, if you do use this scheme then please take a look to ensure that you avoid any costly disputes with HMRC.

One final announcement is the introduction of ‘Gift Aid Intermediaries’ in the Finance Act 2015, which is yet to be suitably implemented. The current plans are to allow donors to make out a single Gift Aid declaration to multiple charities via a named intermediary.

After commission, the intermediary would either collect the declarations and donations and pass on to the charity for the charity to claim Gift Aid, or the intermediary may claim the Gift Aid and then pass on the donation plus Gift Aid to the charity. This should ease the administration process for both the charity and the donor by reducing the need for a gift aid declaration for each individual charity. However, we are still yet to see how successful this is.

As you can see Gift Aid gives donors a further incentive to give to charity and is worth a lot to the entire sector. The new changes have caused some concerns for charities, but it is important that they have strong procedures in place for any Gift Aid Audits and ensuring they avoid repaying any of the gift aid they receive.