The use of hybrid and electric vehicles is becoming more and more popular and now more businesses than ever are using these vehicles for company cars. However, there are many things to consider when providing these to your employees. Below, we take a look at all you need to know regarding taxable charges in relation to electric and hybrid vehicles for your workforce.

Advisory fuel rate for electric vehicles

From 1 September 2018 a new advisory fuel rate of 4 pence per mile applies to electric vehicles. This means that if your employees have electric company cars and they meet the cost of electricity for business journeys, you will be able to reimburse them at a rate of 4 pence per mile without triggering a tax liability or having to report the payment to HMRC. If, however, the payment exceeds 4 pence per mile, any excess over that amount is taxable and you must report the profit element to HMRC on the employee’s P11D or deal with it through the payroll.

Electric charging points

No fuel benefit charge arises if you provide electric charging points for your employees to use to charge an electric company car. HMRC do not regard the provision of electricity to power a company car as a ‘fuel’ and consequently there is no fuel benefit charge if you meet the cost of electricity for employees’ private journeys in an electric company car.

With backdated effect from 6 April 2018, a new exemption is being introduced which prevents an income tax charge from arising if an employee uses an employer provided charging point to charge their own electric or hybrid car, or one in which they are a passenger. However, the exemption only applies to electric charging points provided at or near the workplace and is dependent on charging facilities being available to all employees who wish to make use of them. However, if you have more than one site, you do not need to provide a charging point at each of them for the exemption to apply.

Electric cars

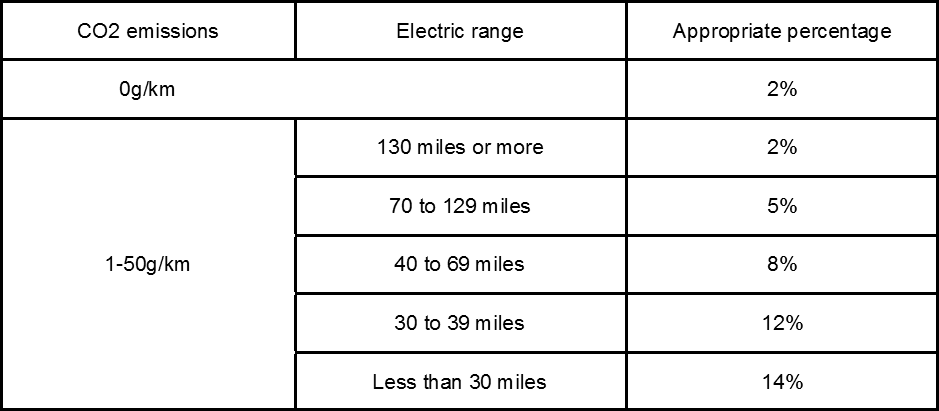

From 2020/21 new company car bands are being introduced which will significantly lower the benefit in kind tax charge for electric company cars. The benefit in kind tax charge for electric cars and those with emissions of between 0 and 50g/km is currently 13% of its list price; this is to increase to 16% for 2019/20. However, from 2020/21, the charge for zero emission cars will drop to 2%, whereas that for cars in the 1 to 50g/km band will depend on the electric range of the car, as set out in the table below:

Looking ahead, the potential tax savings to the employee from choosing an electric car are significant. The reduction in the charge will also reduce the amount of Class 1A National Insurance that you, as an employer, will pay.

If you would like to discuss any of the areas covered above, then please contact us for further details and advice.